What is Tax and Taxation?

Tax means a part of income paid by individuals and business entities to the government or the tax authorities, by whatever name called. Whereas, Taxation is the act of imposing taxes.

Tax systems vary widely among nations, and it is important for individuals and business entities to understand the tax structure of the place where they are planning to do business.

In India, the central and the state government play a very vital role in the tax structure.

-

Direct tax

It’s a tax where the incidence and impact falls on the same person. The burden of tax cannot be transferred to another person.

Currently prevailing direct taxes are:

- Income Tax,

- Corporate tax,

- Property tax.

-

Indirect tax

It’s a tax where the incidence and the impact does not fall on the same person.

Currently prevailing indirect taxes are:

- Goods and service tax;

- Custom duties;

- Central excise duty;

- VAT

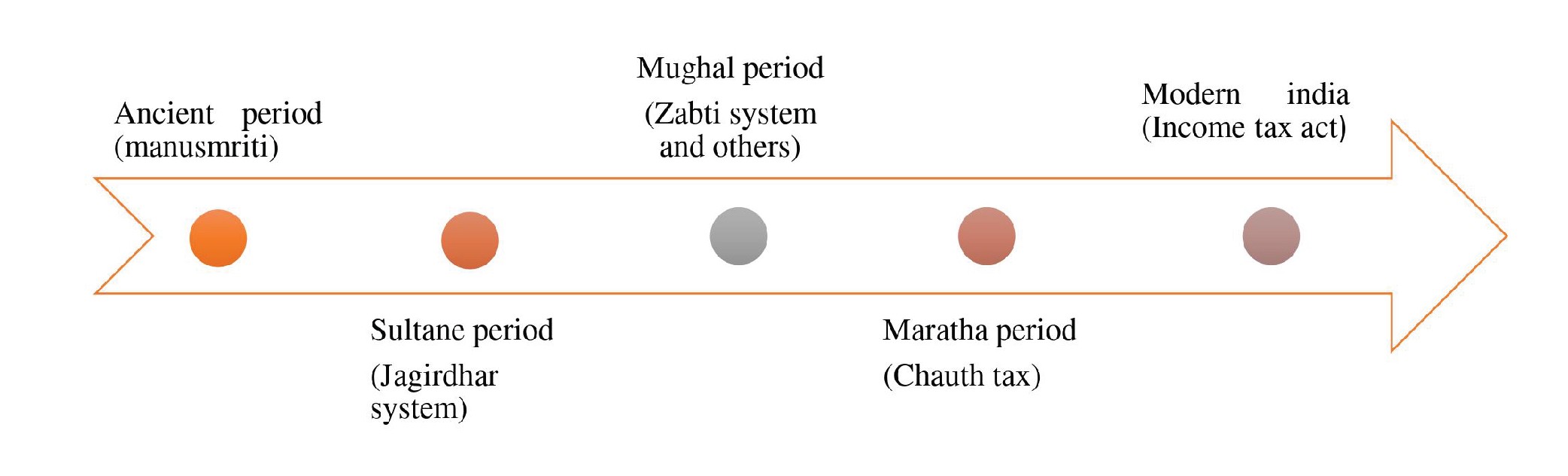

History of Taxation in India

1. Ancient Times:

The history of taxation can be traced back to Manusmriti, the ancient book of laws written by the sage Manu and, Arthashastra, the famous economics book by Kautilya. The main principle of which was to enable the king to discharge his duties and provide protection.

Tax was levied on livestock, land, and products like bamboo, wheat, honey, salt.

2. Medieval Times:

The medieval India consists of various time periods, which saw a drastic development in the tax systems.

- Sultanate period

The sultans of the Delhi Sultanate introduced the jaghirdar system also known as the Zamindari system, where the jaghirdars/ Zamindar governed an estate and were responsible for the collection of taxes.

The land revenue tax, Khijra being the main source of income, imposed only on non-Muslims, though children, children and monks were exempted. Octroi on the commercial goods and Zakat being tax imposed on Muslims.

2. Mughal period

The tax system used in the Sultanate period continued for a long period, however rulers like Sher khan introduced the single price-list system which continued till emperor Akbar introduced the Zabti system under which the one-third of the produced was paid as tax. The tax collected was in the form of kind was later converted at the Dastur (or regional) level using the price schedules.

This tax system was one of the most advance tax systems.

3. Maratha period.

Maharaj Chhatrapati Shivaji overhauled his revenue system and took various notable steps, such that of abolishing the jagidari/zamindari system, fixing tax to two-fifth of the produce payable either in cash or kind, introducing Chauth tax.

3. Modern Times:

It was introduced by the British during their rule. The first Income-tax act was introduced by the British Finance Minister James Wilson in 1860, which has been the basic model of India’s Tax system ever since.

This Act categorised income in Four schedules:

- Income on land/ property.

- Income from Profession and trade.

- Income from securities, annuities and dividends.

- Income from salary and pension.

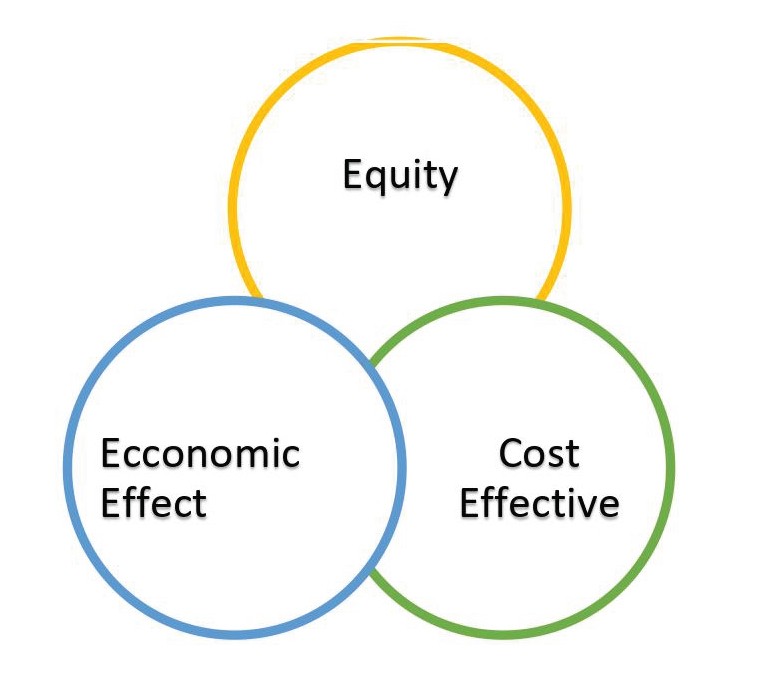

Principles of Taxation:

The basic principles of taxation are:

1. Economic effect: The tax policy may be used to promote economic stability. Changes in tax liabilities not matched by changes in expenditures cushion cyclical fluctuations in prices, employment, and production. Built-in flexibility occurs because liabilities for some taxes, most notably income taxes, respond strongly to changes in economic conditions. A more-active approach calls for changes in the tax rates or other provisions to increase the anti-cyclical effects of tax receipts and reduce the chances of tax evasion.

2. Equity: Every state ought to contribute towards the support of the government, in proportion to the revenue which they respectively enjoy under the protection of the state

3. Cost effective: The rule requires that taxes be established in such a manner as to minimise the real costs of collections, in terms of resources required.

They are subdivided as:

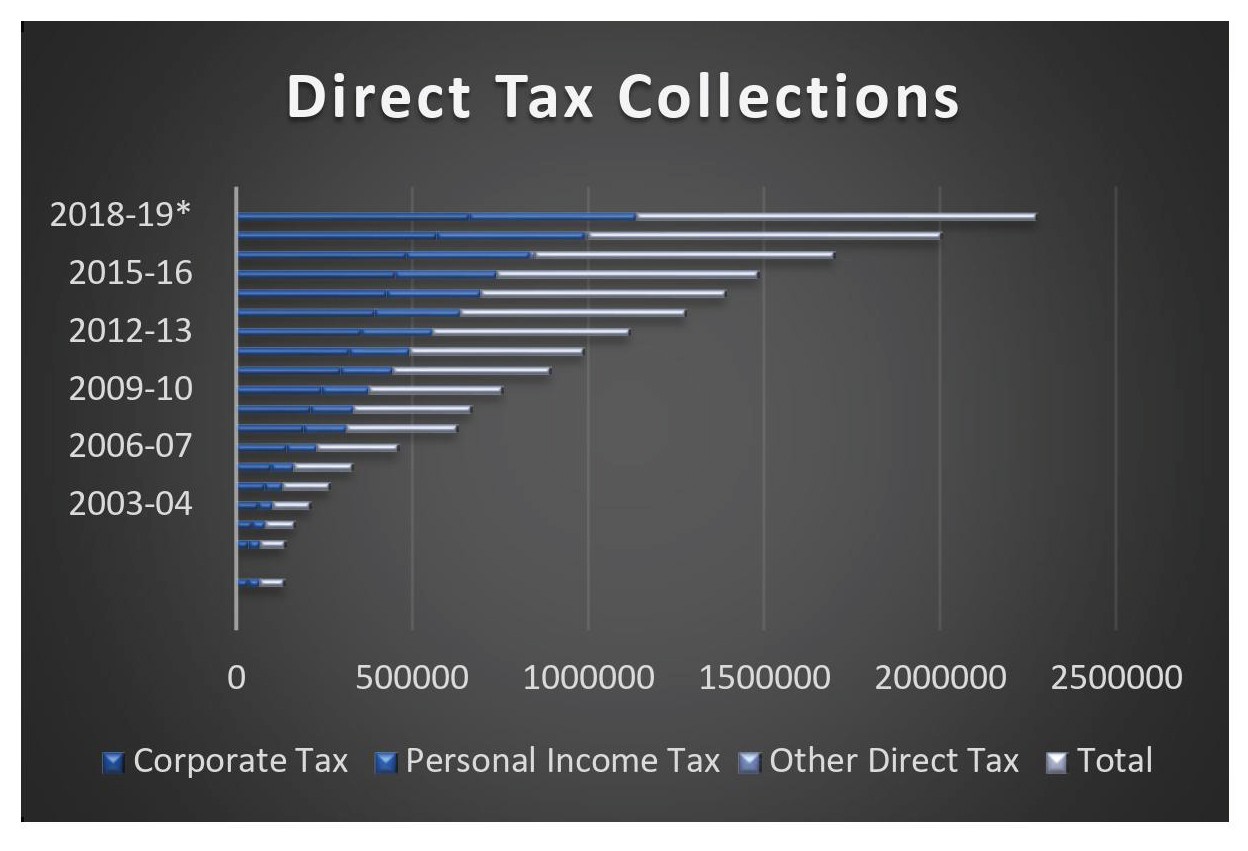

1. Income Tax:This tax is paid by the taxpayers other than companies registered under the Companies Act, 2013 on the income earned by them. They are taxed on the basis of slabs at different rates.

2. Corporate Tax:This tax is paid by the companies registered under company the Companies Act, 2013 on the net profit that it makes from businesses.

It is taxed at a specific rate as prescribed by the Income Tax Act, 1961 subject to the amendments in the Finance Act.

Due dates:

- For Companies: 31st October

- For Non-companies who require their accounts to be audited: 31st October

- For Individuals, HUF & Partnership firms who don’t require their accounts to be audited: 31st July

Applicability:

Income tax is applicable to all companies:

- A domestic company is taxed on its total income earned

- A foreign company is taxed only on the income earned/ accrued/ received within India.

Minimum Alternative Tax

All companies incorporated in India are required to pay minimum alternative tax if the income tax payable as per the Income Tax Act, 1961 is lesser than 15% of the book profits of the company.

MAT would not be applicable if the company opts to pay tax u/s 115BBA or u/s 115BAB.

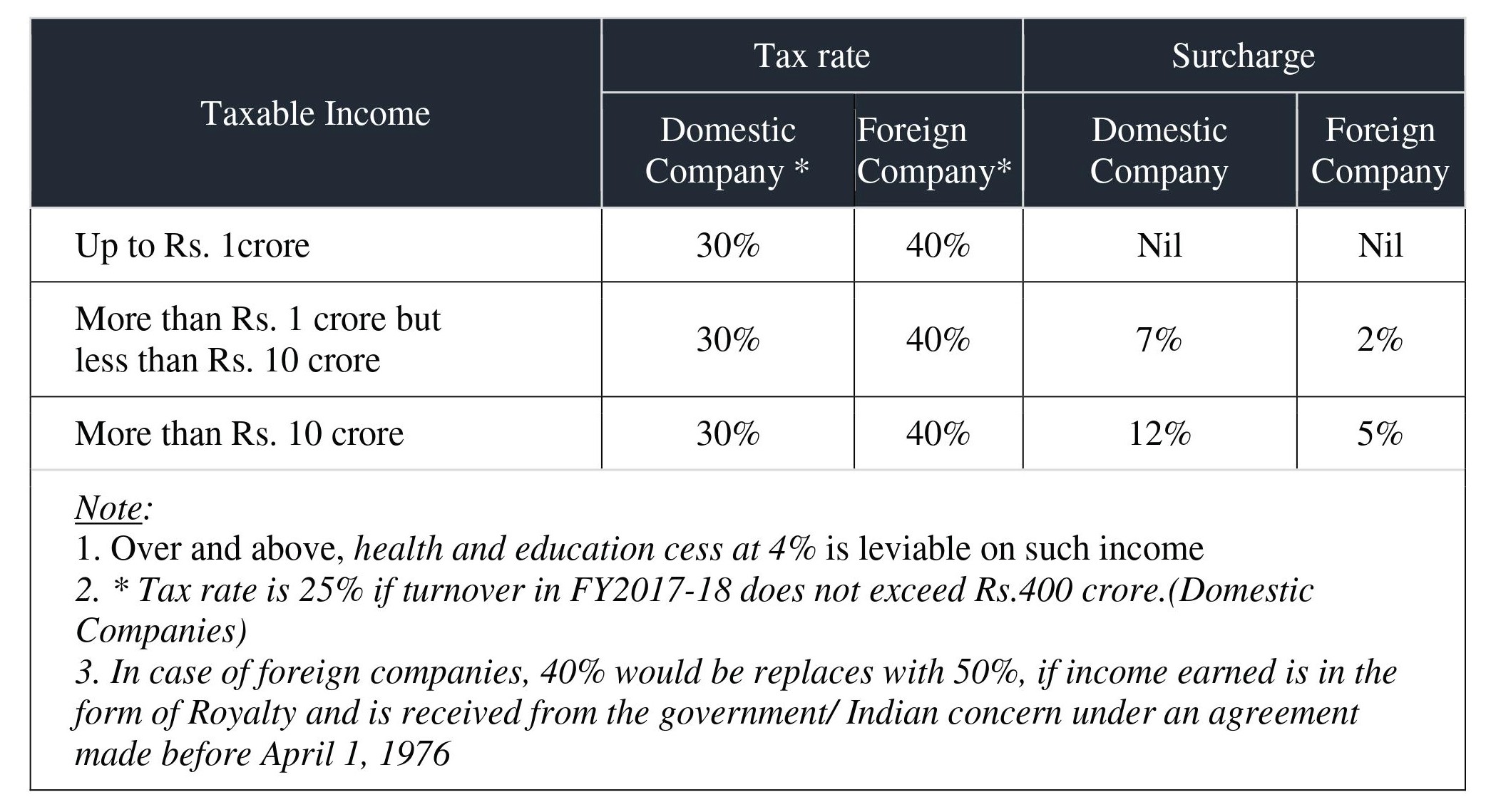

Prevailing corporate tax rates for the Assessment Year 2020-21

Double taxation and DTAA

Double taxation is a situation that arises when the same income is subject to tax, twice.

This can occur in one of two ways –

1. Economic double taxation occurs if an income or a part of it is taxed twice in the same country, in the hands of two individuals.

2. Juridical double taxation occurs if an income earned outside India is taxed twice in the hands of the same individual, once abroad and once in their home country. This unique situation puts an undue burden on the taxpayer.

It also must be noted that tax paid with respect to the income earned in one country, is not allowed as a credit in the other country.

Relief against double taxation can be unilateral or bilateral:

1. Unilateral relief:

As per section 91 of the Income Tax Act, 1961 provides for unilateral relief against double taxation. According to the provisions of this section, an individual can be relieved of being taxed twice by the government, irrespective of whether there is a DTAA between India and the foreign country.

However, there are certain conditions that have to be satisfied in order for an individual to be eligible for the unilateral relief.

- The individual or corporation should have been a resident of India in the previous year.

- The income should have been accrued to the taxpayer and received by them outside India in the previous year.

- The income should have been taxed both in India and in such other country with which there is no DTAA.

- The individual or corporation should have paid tax in such foreign country.

Deduction: If the assessee satisfies the above criterion, he shall be entitled to a deduction at the lower of:

- Indian tax rate

- Foreign tax rate (in the respective country)

If the two rates are the same, then the Indian tax rate would be allowed as a deduction.

2. Bilateral relief:

As per section 90 of the Income Tax Act, 196, it offers protection from double taxation through a DTAA. This type of relief is offered in two different ways.

1. Exemption method:

The method offers full and complete protection from being taxed twice;

i.e. if an income earned outside India has been taxed in such foreign country, it is not subject to tax in India.

2. Tax Credit method:

This method allows the individual or the corporation to claim a tax credit for the taxes paid outside India. This tax credit can be utilized to set-off the tax payable in

India, thereby reducing the assesses overall tax liability.

Recent Comments